Understanding The Role Of Decentralized Finance In The Rise Of Bitcoin (BTC)

Understanding the Role of Decentralized Finance in the Rise of Bitcoin

The rise of Bitcoin, often referred to as the “original cryptocurrency,” has been a remarkable phenomenon that has shaken up the world of finance. With its decentralized and borderless nature, Bitcoin has attracted attention from investors, merchants, and financial institutions around the globe. But what’s behind this sudden surge in popularity? In this article, we’ll delve into the role of Decentralized Finance (DeFi) in the rise of Bitcoin.

What is Decentralized Finance (DeFi)?

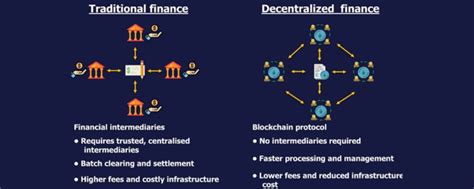

Decentralized Finance refers to a class of financial services and products that operate on blockchain technology, which allows for peer-to-peer transactions without the need for intermediaries like banks or governments. DeFi platforms use smart contracts, a self-executing software program that automates many tasks, to provide a range of financial services, including lending, borrowing, trading, and investing.

The Rise of Bitcoin

Bitcoin’s value has been on an incredible trajectory since its launch in 2009. The initial coin offering (ICO) raised $18 million, but it was the subsequent adoption by mainstream investors that saw the price skyrocket. By 2017, Bitcoin had reached an all-time high, with a market capitalization of over $20 billion.

So, what’s behind this sudden surge? Several factors contribute to Bitcoin’s success:

- Decentralization: Bitcoin is a decentralized currency, meaning that it’s not controlled by any government or institution. This allows for greater security and transparency.

- Borderless transactions: With Bitcoin, individuals can transfer money across borders without the need for intermediaries like banks.

- Low fees: Compared to traditional payment systems, Bitcoin has relatively low transaction fees.

- Security: The use of advanced cryptography ensures that transactions are secure and tamper-proof.

Decentralized Finance (DeFi) in the Rise of Bitcoin

Now, let’s explore how DeFi has played a significant role in the rise of Bitcoin:

- Lending and borrowing: DeFi platforms enable users to lend or borrow Bitcoin with relatively low interest rates, making it accessible to individuals who may not have had access to traditional financial institutions.

- Decentralized exchanges (DEXs): DEXs allow for peer-to-peer trading without the need for intermediaries like brokers or exchangers.

- Stablecoins: Stablecoins are cryptocurrency that maintain a stable value relative to traditional currencies, making them attractive for investors seeking diversification.

- NFTs and gaming platforms

: DeFi platforms have also led to the creation of NFTs (non-fungible tokens) and gaming platforms, which have become increasingly popular among users.

The Future of Bitcoin

As DeFi continues to evolve and mature, it’s likely that its role in the rise of Bitcoin will only grow. Here are a few potential trends to watch:

- Increased adoption: As more users adopt DeFi platforms, we can expect increased adoption of Bitcoin as a store of value.

- Regulatory clarity: The regulatory environment for DeFi is still evolving, and clarity on how it will be regulated may lead to greater investment in this space.

- Interoperability: The development of interoperable solutions between different DeFi platforms and traditional financial systems could unlock new use cases and applications.

Conclusion

In conclusion, the rise of Bitcoin has been driven by a combination of factors, including its decentralized nature, borderless transactions, low fees, and security features. Decentralized Finance (DeFi) has played a significant role in this phenomenon, providing users with access to a range of financial services and products that were previously unavailable.

Decentralised Finance (DeFi) Vs Centralized Exchanges (CEX): Pros And Cons

The great division: cryptocurrency against centralized finances (defi) in the era of decentralized exchanges

In recent years, the world of finance has undergone a significant change. The increase in cryptocurrencies, blockchain technology and decentralized exchanges (DEX) has transformed the way we think about money, trade and financial instruments. Two of the most prominent developments in this space are centralized finances (defi) and cryptocurrency -based exchanges (CEX). While both offer exciting opportunities for investors and merchants, they differ significantly in their underlying principles, benefits and inconveniences.

centralized finance (defi)

Defi, also known as decentralized finances, is a financial technology that operates completely outside traditional centralized systems. Defi platforms use blockchain technology to provide access to financial services, such as loans, loans, shops and investments. Defi’s best known examples are:

- UNISWAP (Ethereum): A decentralized exchange for cryptocurrency trade.

- Makerdao

(EOS): A decentralized loan platform that allows users to borrow and provide tokens.

- Compound (BTC/ETH): a decentralized interest rate management platform.

Defi’s key characteristics are:

* Decentralized governance : decision making is distributed among the participants, reducing the risk of centralization.

* Immutable contracts : Intelligent contracts in Blockchain ensure the execution of agreements without intermediaries.

* Interoperability of the CROSS chain : Ability to transfer assets through different blockchains.

* Low rates and liquidity : lower transaction costs and higher commercial volumes.

Pros:

- Increased security : Defi platforms are more resistant to piracy and censorship due to its decentralized nature.

- Lower transaction rates : Transaction rates are generally lower compared to centralized exchanges.

- Improved User Experience : Decentralized technology allows greater flexibility in terms of user interface, usability and customization.

Cons:

- Limited liquidity

: Liquidity suppliers often lack resources to absorb large volumes of market data, which limits its potential impact on prices.

- Vulnerability to intelligent contract errors : If intelligent contracts are not implemented correctly or have vulnerabilities, they can lead to significant losses for users.

- Regulatory uncertainty : The regulatory panorama is still evolving, and defi platforms may face challenges to comply with existing laws and regulations.

Centralized Finance (CEX)

Traditional centralized finance (CEX) operates through a network of banks, investment companies and other financial institutions that act as intermediaries between investors and financial markets. CEXS provides access to financial services, such as trade, loans and investments, but with a centralized control structure.

The key characteristics of CEX are:

* Centralized infrastructure : Banking systems, financial institutions and investment companies provide liquidity and custody for assets.

* Regulatory supervision : Governments regulate and enforce compliance with laws and regulations.

* Institutional knowledge : Professionals have extensive experience in risk management and informed decision making.

Pros:

- established credibility : CEX are supported by established institutions, providing a sense of trust and stability.

- Liquidity management : centralized infrastructure can administer large volumes of market data, leading to greater liquidity.

- Regulatory compliance : Compliance with existing laws and regulations is generally easier in a centralized environment.

Cons:

- Centralization risks : CEX are vulnerable to centralized control, which can lead to a higher risk of manipulation or piracy.

2.

Exploring The Role Of Trading Volume In Market Analysis

Title: The Power of Trading Volume: Unlocking Insights in Cryptocurrency Markets

Introduction

Cryptocurrencies As Trading volume-the number of transactions In this article,

What is trading volume?

Trading volume refers to the total amount of value. It is not only the number of transactions but the leveling price per transaction, which can Reveal valuable information about market sentiment and liquidity. Trading volume is influenced by several factors, including the overall market trend, news events, regulatory changes, and investor behavior.

Why is Trading Volume Important?

- Conversely, low trading volumes can suct and bearish or neutral market outlook.

- Liquidity : Trading volume can provide insights into the level of liquidity in the market. Higher volumes type indicate more active and liquid markets, while lower volumes may indicate market fragmentation or congestion.

. ,

Trading Volume Trends

.

2.

.

Investment Strategies Based On Trading Volume

- Trend following

: Traders who follows the trend using volume indicators (e.g., bollinger bands or ichimoku cloud) tend to perform better than those who use traditional technical analysis.

2.

3.

Challenges and Limitations

1.

2.

.

Conclusion

Trading volume is a crucial aspect of cryptocurrency markets that can provide valuable insights into market sentiment, liquidity, and price discovery. Trading volumes using volumes volumes indicators and trend patternns, traders can fine and deeper understanding of the market’s dynamics and make informed investment decisions.

The Importance Of Market Research In Cryptocurrency

The Importance of Market Research in Cryptocurrency

As the World’s Largest Digital Currency, Bitcoin Has Gained Considerable Attention and Investments in recent Years. Before Investors, Dealers and Users Can Take Part in This New Market, They Must First Understand Their Subtleties. A crucial aspect that distinguishes bitcoin from other cryptocurrencies is its decentralized nature, which heavily on market research to establish price stability.

What is Market Research?

Market Research Includes The Analysis of Various Factors That Influence The Prices for Assets or Raw Materials, Including Traditional Financial Markets and Digital Currencies Such As Cryptocurrency. It Enables Investors, Dealers and Users to Identify Trends, Patterns and Correlations on the Market and to Enable Well -Founded Decisions about the Purchase, Sale or Holding on To A Specific Asset.

Importance of Market Research in Cryptocurrency

Cryptocurrencies Such As Bitcoin (BTC), Ethereum (ETH) and Others Are Known for Their Volatility and Unpredictable Price Movements. This Unpredictability Makes It Difficult to Predict Future Prices with Certainty. However, Market Research Plays an Important Role in Reducing This Risk By Providing Valuable Insights Into The Underlying Forces That Drive the Prices for Cryptocurrency.

Factors That Affect Cryptocurrency Prices

Several Factors Contribute to cryptocurrency prices:

- Supply and Demand : The Remoining Amount Between Buyers and Sellers Can Significantly Influence the Prices.

- Network Effects : If More People Contribute to the Network, The Value of Each Unit Increases and Creates A Self -Restforcing Cycle.

- Market Feeling : Investor Emotions Such as Fear and Greed Influence the Market Direction.

V.

Regulatory Environment

: Changes to the state guidelines or laws can affect cryptocurrency prices.

Key results from Market Research

Several Studies Have Analyzed the Relationship between Cryptocurrency Prices and Various Factors. Here are some important Findings:

- A Study by Coindesk Showed that 74% of Bitcoin Price Changes Were Influenced by Institutional Investors Who Acquired A Significant Share of Coins Through Stock Exchanges.

- In a research paper published in the Journal of Alternative Investments, it was found that the market mood is closer to short -term price movements than long -term trends.

- Another Study by CryptoSlate Showed that cryptocurrency prices and events in Connection with Traditional Finances Such as Economicators and Regulatory Changes Are Influenced.

Why Market Research or Cryptocurrency is important

While some investors and dealers are willing to take calculated risks on the cryptocurrency market without carrying out thorough research, Others Cannot Afford it. Market Research Offers Valuable Insights Into:

- Preimstrends : Identifying patterns and correlations between prices and other factors can help you make more well -founded investment decisions.

- Risk Management : The Understanding of Market Dynamics Can Enable You to Determine Realistic Price Goals and Adapt Your Strategy Accordingly.

- SAFETY : If you know the potential risks of investing in cryptocurrency, you can avoid costly mistakes.

Best Practices for Market Research in Cryptocurrency

To get the best out of market research, follow the following practices:

- Carry Out Thorough Research : See Serious Sources Such As News Agencies and Academic Studies.

- Disorses Your Analysis : Examine Various aspects of cryptocurrency prices, including supply and demand, Network Effects, Market Mood and Regulatory Environment.

- Consult Several Sources : Collect Information from Several Perspectives in Order to Achieve A More Comprehensive Understanding of the Market.

- ** Stay on the latest.

The Future Of Tokenomics: Insights From Chainlink (LINK)

The Future of Tokenomics: Insight from Chainlink

As the world of cryptocurrencies further develops, one of the most important aspects that have paid considerable attention is tokenomics. Tokenomics refers to the mathematical model used to build and control the cryptocurrency or other digital devices. This includes concepts such as supply and demand, token distribution and usage rates that are essential for understanding the functioning of a particular coin.

Recently, Chainlink (link), one of the leading decentralized data networks, is at the forefront of exploring the complexity of tokenomics. In the innovative approach to creating and optimizing blockchain-based data channels, the link will redefine the possibilities of the cryptocurrency tokenomics.

What are tokenomics?

Tokenomics is a multidisciplinary area that combines elements of economics, computing, mathematics and many more to create sophisticated models for the construction of cryptocurrencies. This includes analysis of various factors such as supply and demand, network effects and market dynamics to determine how tokens work over time.

Tokenomics plays a decisive role in developing the price of cryptocurrency, trading volume and acceptance rate. Understanding tokenomics, developers and investors can make more well -founded decisions on which projects are worth investing or participating.

Approach Chainlink to tokenomics

Chainlink has a unique approach to developing its technology, incorporating Blockchain Economics, Decentralized Finance (Defi) and other relevant areas. The link, like a flagship token, Chainlink offers an unique solution for the construction of robust data channels, which can be used to optimize various aspects of the cryptocurrency trade.

token distribution

One of the main aspects of tokenomics is the distribution of tokens. In a typical token economy, new coins are beaten in a fixed supply and sold through various market mechanisms. As blockchain technology develops further, new approaches have emerged to distribute tokens.

Chainlink focuses on creating a decentralized data network and has resulted in innovative methods to distribute the relationship between stakeholders. The token is not simply randomly divided; Instead, it follows a dynamic model that rewards liquidity service providers, validators and other contributors for their participation in the network.

token utility

Another critical aspect of tokenomics is the concept of token use. The purpose of tokenomics is to create tokens that have special uses or benefits that promote acceptance and use rates. Chainlink’s approach focused on creating a link as a valuable source for data providers, allowing them to earn their money and participate in the network.

LINK UNIVERSITY MODEL

Chainlink’s utility model includes three primary components: data channels, liquidity care and validation incentives. With the encouragement of developers to build and use tokenomic models, Chainlink has successfully created a robust ecosystem that promotes growth and acceptance.

Defi and tokenomics integration

The growth of decentralized financing (DEFI) further emphasized the importance of tokenomics in the development of the cryptocurrency market dynamics. Defi platforms rely heavily on the use of smart contracts on the creation of complex trading and liquidity mechanisms that can be influenced by tokenomic principles such as supply and demand.

The partnership of Chainlink and Defi Projects has allowed them to integrate into these markets and create a network effect that is beneficial to both parties. By integrating tokenomic models into defi platforms, Chainlink not only encourages adoption, but also generates revenue by using the link per useful case.

The Future Of Tokenomics: Insights From Ethereum (ETH)

The Future of Tokenomics: Insights from Ethereum

As the world continues to shift towards decentralized finance (DeFi), blockchain technology, and digital currencies, tokenomics – the study of how tokens are created, distributed, and used – has become increasingly crucial. One major player in this space is Ethereum (ETH), one of the largest and most influential smart contracts platforms on the market. In this article, we’ll delve into the world of tokenomics, focusing on insights from Ethereum.

What is Tokenomics?

Tokenomics refers to the study of how tokens are created, used, traded, and governed within a blockchain ecosystem. It involves understanding various aspects such as supply and demand, distribution, utility, governance, and regulatory compliance. Tokenomics helps developers create successful and sustainable projects by providing insights into how to design, build, and manage their token economy.

Ethereum: A Leader in Tokenomics

As the largest smart contracts platform on the Ethereum network (ETH), our article will explore various aspects of tokenomics from an Ethereum perspective. We’ll examine the following key areas:

- Token Supply: How is the total supply of ETH determined, and what are the implications for future growth?

- Token Distribution: Who gets access to new ETH tokens, and how can developers ensure fair distribution practices?

- Utility and Use Cases:

What types of applications and services will benefit from these tokens, and how can they be designed to maximize their value?

- Governance: How does the Ethereum community govern its own token economy, and what impact does this have on project development?

Ethereum’s Unique Tokenomics Paradigm

Ethereum’s tokenomics is built around the following principles:

- Decentralized Supply: The total supply of ETH is capped at 10 billion units, ensuring that no single entity controls a large portion of the token economy.

- Token Distribution: New ETH tokens are distributed across all nodes on the Ethereum network through a process called “random number generation.”

- Utility and Use Cases: Many decentralized applications (dApps) built on Ethereum rely on ETH as their native currency, while others may use it for specific services or fees.

Ethereum’s Impact on Tokenomics

The success of Ethereum’s tokenomics can be seen in several areas:

- Growing Adoption: The increasing adoption of ETH and other cryptocurrencies has driven the growth of decentralized finance (DeFi) applications.

- Community Engagement: Ethereum’s developer community remains active and engaged, with many contributors actively shaping the direction of the platform.

- Security and Transparency: Ethereum’s focus on security and transparency has contributed to its reputation as a reliable and trustworthy blockchain ecosystem.

Conclusion

The world of tokenomics is rapidly evolving, and Ethereum is at the forefront of this shift. By understanding the intricacies of tokenomics, developers can create successful projects that benefit from a well-designed and governed token economy. As the DeFi space continues to grow, it’s clear that Ethereum’s unique tokenomics paradigm will play a vital role in shaping the future of digital currencies.

Sources:

- Ethereum Whitepaper (2014)

- Ethereum Team Blog

- CryptoSlate (2020): “The Future of Tokenomics on Ethereum”

- CoinTelegraph (2020): “Ethereum’s Tokenomics and Its Impact on DeFi”

Note: This article is a general overview of tokenomics and Ethereum, and not an exhaustive or definitive guide.

Ethereum Virtual Machine: Powering Decentralized Applications

REA’S A Draft Article on Eetherumo Virtual Machine: Powering Decentralized Applications”:

Title: Ethereum Virtualized Machine: Powering Decentralized Applications

Introduction:

The Ethereum of Virtual Machine (EVM) is the derlying technology tohat enable the decentralized application of the Etherem blockchain. It dares to create and deployed smart contracts, which bare self-executing contracts with specifying rules and conditions, witout for acentral authority or intermediaries. The EVM’s Power Lies in Is Abiility to Execute Code on the Blockchain, Providing and Transparent Plan for Decentralized Applications (DApps) to Run.

What is the Virtual Machine?

The Ethereum Virtual Machiine (EVM)) is a virtual machine designer specified specified the Ethereum blockchain. It is concessed of a set of bytecode resistance to the Solidity, a programming guitar use writing for writing rects. The EVM execute the bytecode instructions on the Ethereum Network, allowing developers to create and deploy decentralized applications.

how dos it work?

The EVM work by compiling Solidy Code into bytecode, white is the executive on the Ethereum Blockchain. This process involved steps:

- Complace : Solidy code is compiled to bytecode a compiler.

- Bytecode Executation : The compiled bycode is executed on the Etheretum Network.

- Virtual Machine Execution : The EVM Executors The Bytecodes Instructions, Providing A Secure and Transparent for Decentralized Research Applications.

* Benefits of Ethereum Virtual Machine: *

The Ethereum is virtual maker benefits for decentralized applications:

- Securiity : The EVM Ensure that that smart is executed securly and transparently, reducing the risk of malicious activity.

- * Scalability : The EVM allows decentralized applications to scale horizonally, increased their performing and throughput whith sacrified security.

- Internetability : The EVM enable selves veinsween differed blockchain networks and platforms, promoting decentralization and internationalability.

Real-World Examples:

The Ethereum of Virtual Machiine has been using in variant Real-World Examples:

- Decentralized Finance (Def) : EVM-Powered Dapps Have Enscentralized Learing Decentralized Learing, Borrowing, and Trading Services.

1

- Gaming : EVM-powered gaming platforms alone introduced new revenue streams for game developers and players.

Conclusion:

The Ethereum is virtually for powerful technology tohat enable reliable decently applicants, transparent, transparent, transparent, and efficiently on the ethereum blockchain. Its ability to execution bytecode instructions provisions a robust platform for Building and Deploying Smart Contracts, with numbers Real-World Exasples of Demonstating Its Portial. As the use of cryptocures continuing to grow, the ev will play with increased roles in powering decentralized applications.

References:

- [1] Virtual Machine (EVM) Whitepaper (2020)

- [2] Soliditity of Landaal Reference (Etherreum.org)

- [3] Decentralized Finance (Def) on Ethereum (Decentralized Finance Finance)

Note this is just a draft art, and you can modify it with forgiveness by forgive you from your requirements.

Total Value Locked: A Key Metric In DeFi

0

Entry

The increase in blockchain technology has created a new financing era, known as decentralized financing (DEFI). DEFI platforms allow borrowing, lending and trading peer-to-peer without the need for brokers, enabling people and institutions to control their funds with greater security and efficiency. One of the decisive measures that emphasizes the DEFI potential is the total blocked value (TVL), which measures the total number of the DEFI protocol blocked through transactions.

What is the total blocked value?

The blocked total value refers to the total transfer or blocked value to the decentralized application (DAP) or the protocol in a certain period. In other words, cumulative sum of all events in the platform or network. This meter provides valuable views on the introduction and increase in DEFI protocols.

Why is total value important?

The value blocked in the DEFI protocol has become more and more significant in recent months due to institutional investments and a growing user base. Here are some reasons why TVL is of key importance:

* approaching the attachment : TVL helps to determine the level of implementation of DEFI platforms, which is necessary to measure their potential impact on a wider economy.

* Growth monitoring : TVL serves as a key DEFI growth indicator, which allows investors and market parties to assess whether the asset class is growing or calculated.

* The impact of liquidity

: TVL is increasing, as is the liquidity available to the DeFI protocols. This increased liquidity can lead to higher prices, which makes real estate more attractive to investors.

an increase in closed total value

TVL has grown enormously over the past year and with several significant milestones:

* 2020

: TVL reached $ 10 billion in 2020, compared to USD 1.5 billion in 2019.

* Q2 2021 : TVL for the first time exceeded $ 100 million in the first quarter of 2021, setting a new record for Def.

DEFI trends and forecasts

DEFI -Pinting is bright and has many trends and forecasts to edit them:

* Increased party : Waiting for a continuous increase in adoption when more institutions enter the market.

* Adjusting control : The regulatory environment remains an important factor that leads to Defi development.

* Extraction of liquidity : It is expected that improving the VEFI protocols will increase, which will make them even more attractive to investors.

application

The closed total value is a significant measure of understanding and implementation of DEFI protocols. As institutional investments increases, TVL remains an important indicator of the industry potential. By following this critical meter, market parties can better understand the possibilities and challenges of the DEFI space, ultimately making informed decisions regarding their investment.

investor alarm

If you are considering investing in a DEFI protocol, remember that TVL is just one issue. Study thoroughly, assesses the ability to create risk and contact the financial advisor before making investment decisions.

other resources

For more information on the total lock of values and DEFs, see these resources:

* Coingecko : The largest option of cryptocurrency with market value.

* Coinmarketcap : leading cryptocurrency supplier.

* DEFI loan : Platform that provides information on the loan report.

The Role Of Market Makers In The Trading Of Litecoin (LTC)

The role of market manufacturers in Litecoin (LTC)

Litecoin (LTC), an electronic cash system between pairs fastest growing cryptocurrencies in the market, Litecoin is not only negotiated by individual investors but also by institutional merchants seeking to capitalize on the growing value of the asset. However, Litecoin’s trade is not exempt from challenges, participating when it comes to managing the risk.

Market creators: a key player in Litecoin’s trade

One of the main ways in which markers participate in the Litecoin trade is to provide liquidity to the market. Market manufacturers are companies or people who buy and sell active A in the context of the negotiation of Litecoin

Market manufacturers in Litecoin provide several benefits for merchants:

1.

2.

.

How market manufacturers work in Litecoin’s trade

Market manufacturers in Litecoin usually operate through two main models:

1.

2.

Gains, including:

- position dimensioning : Market manufacturers adjust the size of their positions

2.

.

Benefits for merchants

The participation of market manufacturers in Litecoin’s trade offers several benefits for merchants:

- Improved execution

: Market manufacturers help merchants to execute more effective operations when providing access to buy and sell orders at competitive prices.

2.

.

Challenges and limitations

While the markers play a crucial role in the Litecoin trade, there are also several challenges and limitations to consider:

1.

2.

- Competition :

Conclusion

Litecoin (LTC), which provides liquidity services, risk management and prices discovery of merchants.

Moving Average Convergence Divergence: Understanding Its Significance

Cryptocurrency – Divergence of glinging diameter convergence (MacD): Unlocking Secrets to thesuse of trading

There is no strategy more effactive of the solid understanding of technical analysis in the financial trading. One of thees techniques that gained popularity in recent yours is the divergence of the convergence of the convergence of the sliding diameter (MACD). MACD is an advanced indicator uses by traders and informed informed decisions. In this article, we dive the MacD world and examine its meaning, components and consumers.

What is MacD?

The divergence of the convergence of the sliding diameter is a technica indicator that brings two sliding diamters (MA) agaiinst each. The first is the exponency weighed average of the first of the thee for the specification period, it the second! The resulting graph shows wary diamethers vary, indicating potential brands.

MACD components:

The traditional MacD consists of this lines:

1.

2.*

26-Period EMA : This line is a medium-term dinamics that isly aalyze tanger-term trends.

3.

How MacD Works:

When Ema Ema 11-Periody crosses over 12-Pperiod Ema, it is called the purchase. On the contrary, as they passes below This cross-model suggests that theee been a significant brand.

Divergence:

Divergence occurs wen the MACD line (crossover) is not treated with the price of theyzed safety. For example:::

1.

- When Ema Ema 11-Period and 26-Period crosses over 12-better EMA : That May be a hint of the bull or sequel.

This technica indicators:

To add more layers tolysis, consister incorporating additional technician indicators to MACD strategy:

1.

- RSI (relative force index) : This indicator provides amarketum whe standing deviations and percentage.

3

Bollinger’s bands : These bands cantify volatility and trinds in the price.

Proven procedures to access MacD:

To make the most of the MACD, follow thees procedures:

- Use it as a separate indicator

: Do not relyly on MacD; Use it to complement of indicators and patterns.

- Combine with one of technicians : Consider incorpoorating MacD into your overall business.

3

Beure of the wargence of divergence : Be careful foul divergences that can be indicate in the market.

Conclusion:

MACD is a powerful indicator uses by merchants and informed decisions. By understanding its components, patterns of consumers and procedures, you can unlock Be sure to co-combine MACD with this technical indicators and remain for divergence warning signals.

More sources:

For further reading and guidance wen using MacD, examine the following sources:

1.

- MACD chart system by John J. Murphy : Detail’s book on MACD for effactive analysis.

Reneeing of responsibility: